The primary tool we use for due diligence is called CoreValue and is one that has been used by over 10,000 companies and has generated over $7 Billion of additional company value. Developed at MIT, this tool is accepted by the National Association of Certified Valuators and Analysts (NACVA). It has been adopted by 50% of the National Institute of Standards and Technology (NIST) offices.

CoreValue Software (US Patent 9,607,274) has been used by business consultants on thousands of companies with aggregated gross revenues of ~$200B. CoreValue Software uses the only operational methodology born at MIT, accepted by NACVA, adopted by over 50% of NIST manufacturing centers, and promoted to the American Cities Business Journals readership of 16MM.

The average Gross Revenue (GR) for companies assessed using CoreValue is $24.32MM. The mean is $10.47MM. The system has been used by advisors with companies from main street to divisions of multinationals. The sweet spot for these assessments is GR $2.5MM to $100MM. CoreValue-powered programs have delivered a 21.63% average GR growth annually.

How CoreValue Works

With the help of our diagnostics, we analyze your company across all of its operational areas to reveal its true strengths and weaknesses. You will find out what your business could be worth and how to get there. Regardless of whether you are thinking of exiting or want to continue to operate your business for years to come, this is essential information that will benefit you and your business.

Think of your business as a complex machine. In order to function at a high level, all the gears must be in good condition. Unfortunately, the average company has many “worn gears”, although management may not know exactly which ones are worn. Our diagnosis allows us to pinpoint the worn gears, which is the first step to affecting a repair of the performance inhibiting area.

Our analysis examines eighteen key drivers; nine Market drivers and nine Operational drivers which are shown below.

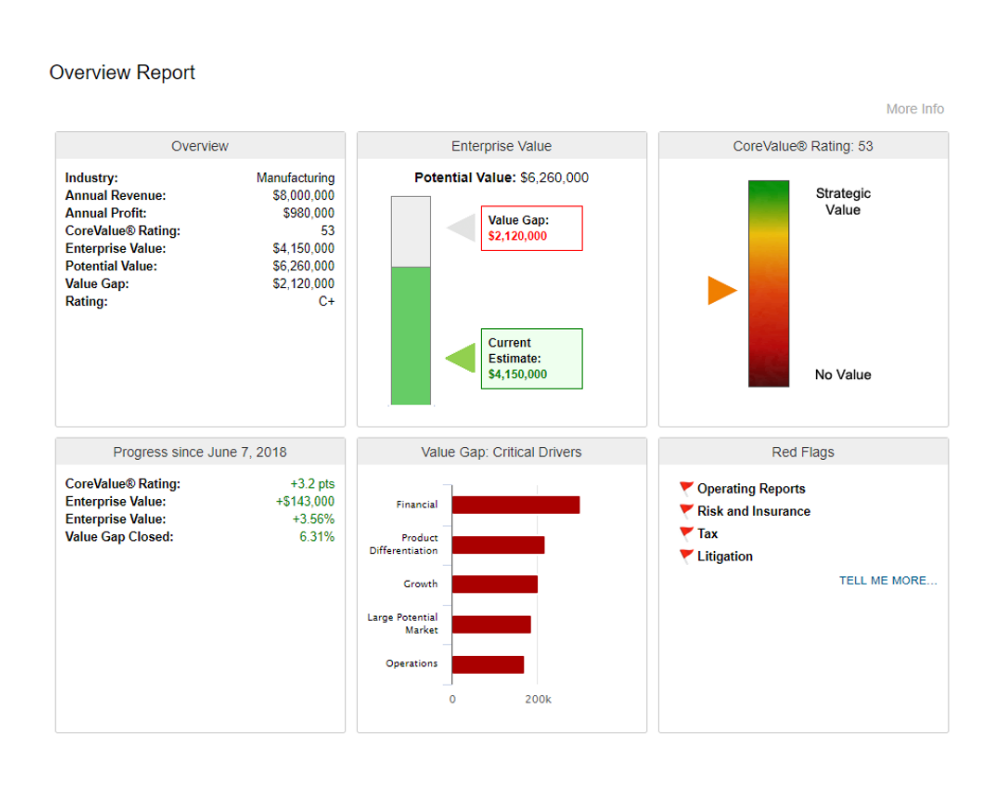

Our initial Discover analysis which we call Discover can be done in about 15 minutes, either by the Business Owner or in conjunction with one of our advisors. An example of a portion of the resulting report that is produced is shown below.

The company potential value and value gap is shown along with the key drivers of the value gap. Critical red flags are also noted.

For our whitepaper with more detail on the entire process, Click Here or call us at (704) 953-5608. Or to perform your own CoreValue Discover analysis, Click Here.