Exiting your business such that you satisfy your individual goals is much more likely with a written plan, just as operating your business following a plan increases the likelihood of success. Exit planning is a process, not an event. For a definition of an exit strategy plan consider the following:

An Exit Strategy Plan is:

The written goals for the succession of a business’ ownership and control, derived from a well thought out and properly timed plan that considers all factors, all interested parties, and the personal goals of the owners in a manner and a time period that is accommodating to the business, its shareholders, and potential buyers. *

* From Exiting Your Business, Protecting Your Wealth, John M. Leonetti

Successful Exit Planning

An exit plan strategy is not determining how to sell the business to an outside buyer for the highest price. That may ultimately be the path chosen, but if it is, it will be based on an intentional analysis of the situation to down select from the various options to that choice. Selling one’s business to an outside party is only one of several alternative means to exit the business.

At Duke Business Advisors, we use a process followed by Certified Business Exit Consultants (CBEC®). The International Exit Planning Association (IEPA) is the governing body responsible for establishing and maintaining standards for the CBEC® designation. CBEC® designees form a national network of senior-level advisors who are all trained and supported in a common system to deliver high quality, customized solutions to business owners regarding the eventual exit from their privately-held businesses.

The Exit Process

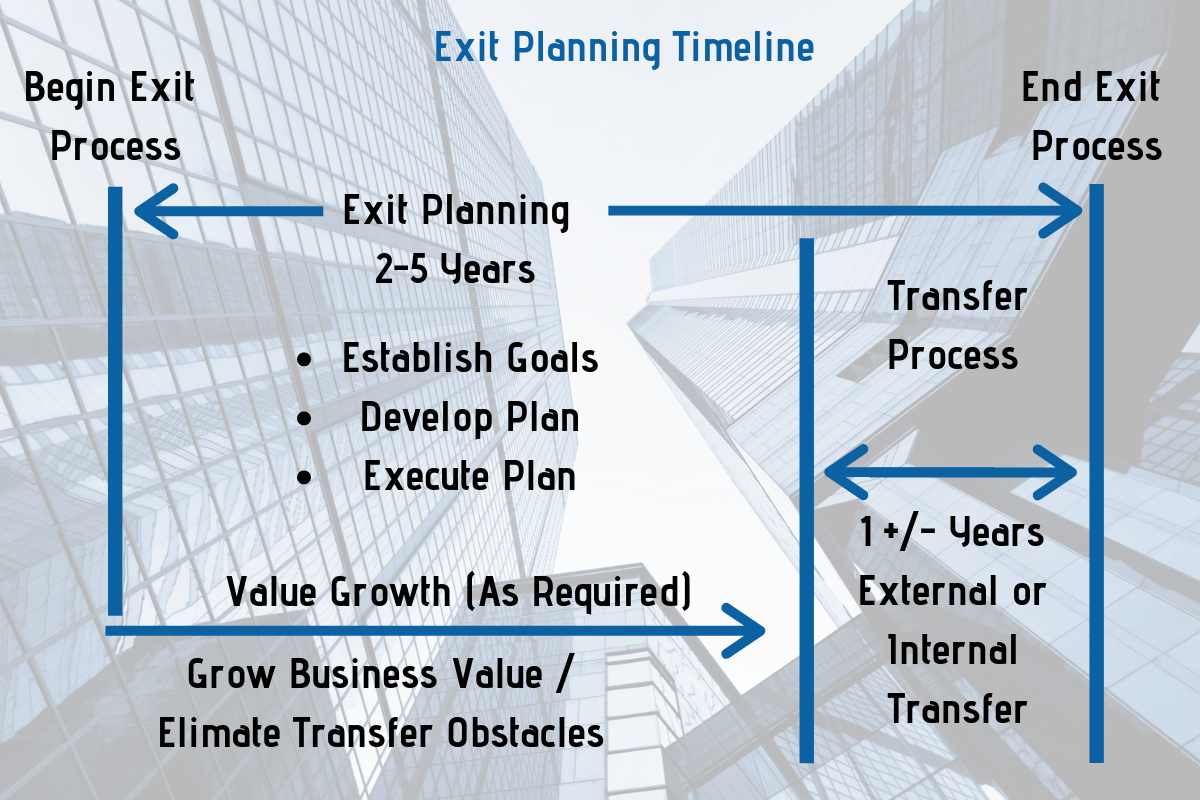

Schematically as shown in the diagram below, an exit process will generally involve three activities. These three activities as shown are Exit Planning, Value Growth, and The Business Transfer Process. The time required to accomplish a successful exit will vary based on the specific owner and business situation. The approximate time period to plan for is two to five years. If the business is in “good” condition for transfer and the required value exists to satisfy the owner’s needs, the time period can be reduced. But if significant changes need to be made within the business then the time needs to expand in order to have the time to effect the changes required.

Value Growth Process

Developing an exit strategy plan has been defined above. The Value Growth Process is the process to grow the value of the business to meet the owner’s needs upon exit and to remove any transferability obstacles. One common obstacle is too much owner dependency, among several others. Duke Business Advisors Value Growth Consulting’s purpose is to identify those obstacles and business deficits and help the business owner make the necessary changes.

Business Transfer Process

The Business Transfer Process involve the specific actions required to transfer the business ownership from the current owner to another party. This could be through an external transfer. Options here include sale to an outside buyer, who could be a strategic buyer, financial buyer or competitor. Another external transfer alternative could be a Private Equity Recapitalization. Internal transfer options include Employee Stock Option Plans (ESOP), gifting to family members or a management buy-out.

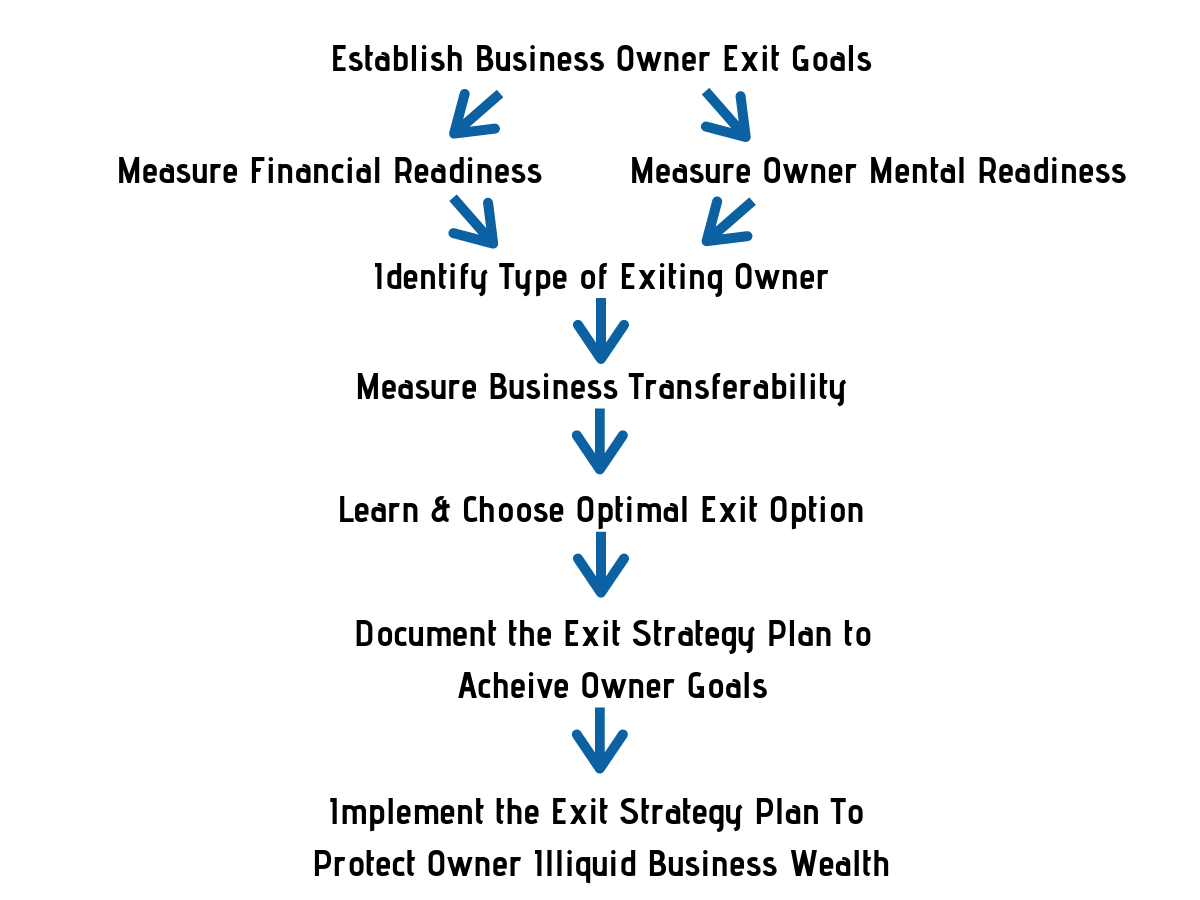

A simple overview of the process is as follows:

This entire process is a Team affair. The Exit Planner acts as the leader and facilitator. The other members of the Team will likely include, among others a Financial Adviser, Estate Planner, CPA, Attorney, Insurance Advisor and M&A Professional. All should collaborate together to accomplish the goals of the business owner in the best manner possible.

Watch the video below on Exit Strategy Planning to learn more about the Exit Planning process.

For more information on the Exit Planning Process, please contact Duke Business Advisors, 704-953-5608.