Have you ever found yourself thinking….?

- Why are we are having trouble meeting our revenue and profit numbers?

- My bookkeeper tells me we are making a profit; then why are we always short of cash?

- How do we stack up to others in the industry?

- How can I ensure I have the data I need to make good business decisions?

- I’m frustrated and know we can do better, but what should we work on first?

- My company is almost totally reliant on me. How can I get more time off for myself or for my family?

- I am working more and more, and we still aren’t getting ahead!

- My team is dysfunctional; their performance is not close to what I think it should be.

- I am thinking about selling my business - what is a realistic price that I could receive?

- Is my business even sellable or do I need to make “fixes” to get any offer?

- I want to get an investment or a loan, but would my business qualify?

Whether being a business owner is relatively new to you or you have been at it for years, it can be frustrating to have these kinds of questions, doubts and concerns. Since most businesses don’t make it to their ten-year anniversary and very few businesses make it past $1 million in revenue these concerns can be more than frustrating. And just because the business makes it past the $1 million revenue doesn’t mean these sorts of issues go away. These are universal issues, and we have found they scale from small to large companies.

SO, WHO IS THIS FOR?

Our services are for all business owners and executives who are experiencing business challenges and may need help turning their company – one area at a time – into a best-in-class operation. It is especially aimed at anyone who is working too many hours and not making progress, an owner doing “okay” but wanting to do better and grow, one who may need to access capital or implement a succession or exit plan in the next few years. In short, this applies to you.

SO, WHAT CAN YOU DO?

- DO NOTHING.

You could plug along doing the same thing – but expecting different results. But isn’t this just kicking the problem down the road?

- KEEP PUTTING IN MORE TIME.

You could hope that if you put in even more hard work and perseverance that you’ll start seeing greater results. (But so much for more family time!)

- GET HELP.

Of course, getting help is always an option. But here is the big question. How can you discover the real strategic or tactical issues holding you back? And can it be done quickly and at an affordable price?

WHY IS BUILDING BUSINESS VALUE IMPORTANT?

For a business to stand out — and attract the highest offers when you want to sell — it must be operating at peak performance. If you aren’t contemplating selling, consider that a valuable business is generally a profitable business and a whole lot easier to operate. This directly translates to more money in your bank account and more time for yourself to use as you wish.

If you are intending to sell, know that investors are sophisticated buyers. They can easily identify issues that affect your business’s value. Private investors, commercial bankers and equity groups are in the business of acquiring businesses. They will work with a team of professionals to perform due diligence into every aspect of your business, including accounting, management, operations, and credit history.

This may be your first or second business to sell. But you will likely be working with a buyer who has purchased many companies. Since you are not a professional seller, working with a professional buyer puts you at a disadvantage. But, with Duke Business Advisors, you can bridge that gap. Using our proven system, we will reveal and resolve blind spots in your company before you sell and then we can represent you for the sale. If selling is not your goal, we will help you build a more profitable and enjoyable business to operate.

THE FINANCIAL IMPACT

Consider two similar companies in the same industry. Each have $25 million in revenue and $3 million in EBITDA. One sells at a multiple of 4 and the other at a multiple of 6.5. Do the math.

$3,000,000 X 6.5 = $19,500,000

$3,000,000 X 4.0 = $12,000,000

Difference = $7,500,000

The higher value company has all its key market and operational drivers in order and working together. This is the impact that we can bring to your business. And by the way, if your numbers have one less zero on the end, it still works!

THE EMOTIONAL IMPACT

A valuable business is typically a more profitable business and an easier business to operate. More money in your bank account and more time for yourself gives you more options.

BUILDING VALUE REQUIRES STRATEGIC CHANGE

To make your company more valuable, changes will need to be made. It will take time and hard work. But by engaging with Duke Business Advisors you will spend time on the most meaningful changes to drive value. Further, as you move through the program, you can track your progress against benchmarks, measuring your improvement as you go.

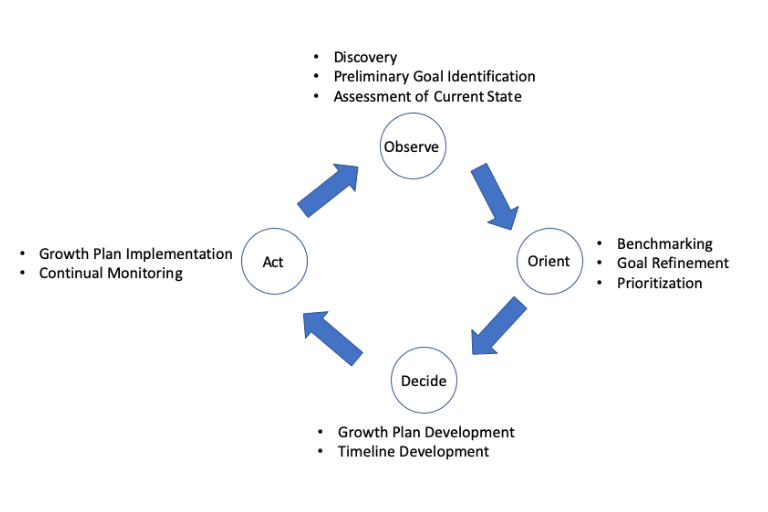

THE DBA BUSINESS GROWTH PROCESS

The DBA Business Growth Process, shown below, provides a proven way to accurately assess a business’ operational strength, craft a plan to address the issues identified, and move forward with solutions to achieve a more valuable, profitable, and stronger business. At Duke Business Advisors we use proven methodologies not only to uncover core problems or inefficiencies your business is facing, but also to show what fixing those core problems is worth to you and your business. Through a process utilizing a variety of diagnostic tools and guidance, we can effectively help you solve business challenges. It is about developing business optics to enable more effective management of your business.

Since business value is generally dependent upon a business’s profit and its operational performance, that is what we focus on. Specifically, our first steps are to benchmark your business to determine where it stands relative to its industry peers. We do this both financially and operationally. These benchmarking activities use different tools, so the two activities can be done in series or parallel. But they both should be done in order to uncover your business’ fundamental performance level. Making useful change that will impact business value and performance requires accurate identification of the specific issues that need to be addressed. That is what benchmarking accomplishes.

Financially benchmarking your business against its industry peers identifies if it is performing at or above the level it should be for your particular industry. You need to know how your business compares to its industry peers. If your business is lagging the industry in terms of key financial metrics like profit margin, then you need to ask why and address the issues uncovered.

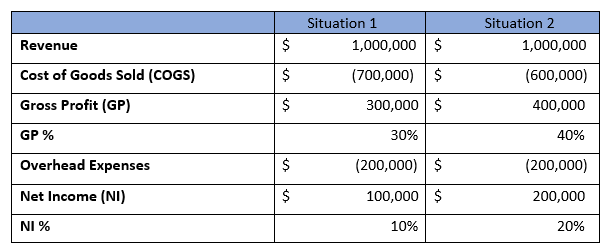

Consider the very simple example shown below.

Here is a hypothetical business with $1MM in revenue and a gross profit margin percentage of 30% as shown in Situation 1. When the business is financially benchmarked, it is discovered that this business in this industry should have a gross profit margin percentage of 40%. So, the changes necessary to accomplish that are made.

The results of those changes are shown in Situation 2. Note that the net income has doubled, and this was accomplished without any additional sales and marketing activity or expense.

Of course, there is work to be done to accomplish these changes, but it begins with accurately identifying what needs attention. That is what financial benchmarking does for the business owner. There is more that can and should be done in the financial arena for a business, such as analyzing financial trends. Analyzing data over a time period provides insight into whether a specific parameter is getting better or worse. This involves creating business management optics from the businesses’ financial documents in order to expose areas in need of attention. Good decisions can’t be made unless you have a way of “keeping score”.

The other benchmark activity is to measure your business against its industry peers on key operational drivers. To do this Duke Business Advisors uses a tool called CoreValue. To learn more about CoreValue, Click Here.